By Scott Amero

Immediate past Rare Board Chair

Trustee of Rare’s Board of Directors

Former BlackRock Vice Chairman and Global Chief Investment Officer, Fixed Income

As a former chair of its Board of Trustees, and long-time member of Rare’s Board, I know Rare well, and want to share with you some of the reasons why my family is investing in Rare now. First, this is a critical 5 years for our planet and humanity to act. Second, the financial and economic conditions of high-net worth people are more favorable for philanthropy than ever before.

And there is no organization better poised to act than Rare. Rare’s strategy lays out a clear way that they will inspire and empower millions of people across thousands of communities to protect the nature and livelihoods that sustain them.

Why now?

-

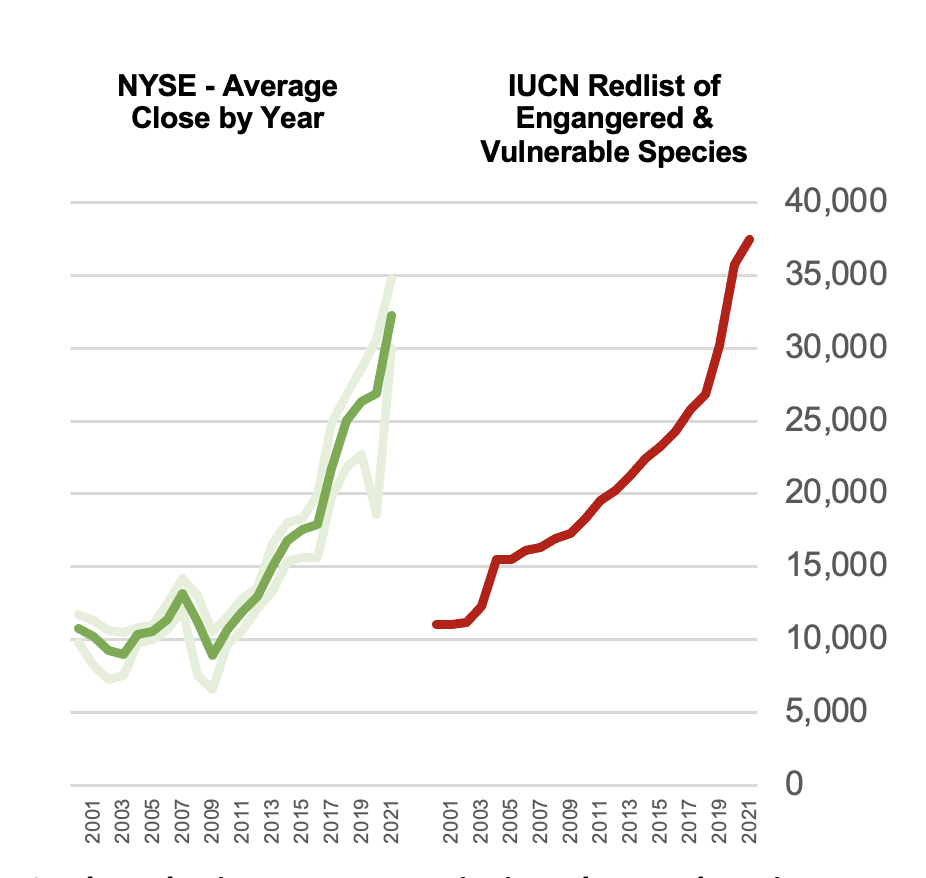

Stock market increases versus rise in endangered species: Correlation is not causation, but this is a stark reminder of the fact that while financial fortunes may have risen, the planet’s resources remain under threat. The stock market’s run-up allows donors to give more through appreciated stocks and favorable tax treatment. The stock market is at an all-time historical high and unfortunately habitat and species loss, climate change and threats to vulnerable communities are climbing alongside it. We can counter this in ways that benefit people, the planet, and our portfolios. Making a gift of stocks employs your capital gains for philanthropy and increases your donation’s value. You can increase your donations before fortunes change.

- The Dorothy Batten Challenge will double your first-time or increased gift. At this time of year most non-profits promote 1:1 matches, but thanks to the visionary leadership of our board chair Dorothy Batten, Rare’s match is truly impressive. Dorothy will match new donors and every dollar donated above a donor’s previous gift, up to $10M, if the donation is unrestricted.

How can you capitalize on this moment?

- Give more by donating appreciated stocks: By donating stock or securities that you have held for more than a year, you can avoid paying capital gains taxes. Given that the effective capital gains tax is 23.8% (and could go higher), this increases your giving power significantly compared to a cash gift, especially for securities with significant appreciation.

- If you donate the stock directly to a charity, you do not need to pay a capital gains tax.

- You are still eligible to deduct the full fair-market value of the donated asset, up to the overall amount the IRS allows

- Your appreciated assets can include assets that are not publicly traded, like restricted stock, real estate, or Bitcoin.

- Potentially reduce future capital gains tax: If you donate some of your appreciated shares and then buy new shares of your favorite stocks, you reset your cost basis at the current, higher price—thus reducing your future capital gains tax exposure if the stock value continues to grow.

- Rebalance your portfolio while increasing your donations: Donating stocks can help if it is time to rebalance your portfolio to maximize performance and optimize for risk. “This is also a great opportunity to take a look at concentrated positions in your portfolio and contribute part of them to a donor-advised fund,” says Margot Navins, a vice president and charitable planning consultant with Fidelity Charitable. “Concentrated positions often come with a personal significance—perhaps you worked at the company for 35 years. This allows the investor to transfer the emotional attachment to charity while also minimizing capital gains tax.”

- Your Donor Advised Fund (DAF) is a super tool right now: Your DAF is earmarked for philanthropy. There is more to give away; it has already grown and appreciated tax-free. And, if you spend your DAF, you can replenish it and save money on taxes because capital gains taxes will likely increase. There is a minimal opportunity cost to spending out your DAF. So it is just a matter of allocating it to Rare. See here for more DAF facts and figures. (Rare’s Tax ID: 23-7380563)

Please join me

Rare is stepping up to do its part as humanity faces immense but solvable challenges. We know from experience that the cumulative power of individual and collective action is a vital pathway to safeguard and restore our shared resources. With your enhanced support, we can scale people-centered environmental solutions and pave the way for lasting change.

I hope you’ll join me in investing in Rare for the future of the planet we share.

Click here for more information on ways to support Rare’s work.

Rare’s Tax ID: 23-7380563