The Small-Scale Fisheries Impact Bond

Rare’s Small Scale Fisheries (SSF) Impact Bond is an innovative financial instrument designed to channel private and philanthropic capital toward the revitalization of coastal communities and ecosystems. The SSF Impact Bond will finance community-led co-management of small-scale fisheries, a proven pathway to meeting the needs of people and nature. The first-of-its-kind Bond uses a novel outcome-based finance (OBF) model that ties financing to results: Funding is only paid out once pre-defined results are independently verified and achieved.

How does the SSF Impact Bond work?

The Bond is structured as a contract; an agreement among multiple parties — investors, service providers, and outcome funders — to achieve specific social or environmental outcomes. The structure involves:

- Investors who provide upfront capital to fund the program or initiative.

- Service providers to implement the project or intervention, aiming to achieve the predetermined outcomes.

- Outcome funders including governments, philanthropic organizations, or other entities that agree to pay for the outcomes achieved.

Over five years, the investors fund activities to support the sustainable management of the small-scale fishery and a strengthened local blue economy. As these activities deliver results verified to meet outcome metrics, outcome funders purchase these results, paying back the investors their initial capital with interest depending on the outcome metrics achieved.

What issue does the Impact Bond help solve?

Despite modest progress, global investment in improving ocean health remains woefully inadequate.

- Funding needed to protect 30 percent of the ocean is estimated at US$9-12 billion per year. Current spending in Marine Protected Areas (MPAs) globally sits at US$1 billion.

- The United Nations Sustainable Development Goal (SDG) 14 – Life Below Water – is the most underfunded SDG, representing 0.01% of SDG funding up to 2019.

- Although coastal seas represent the ocean’s highest concentration of biodiversity intersecting with the areas of highest human need, less than 15% of ocean philanthropy is dedicated to community-based coastal habitat conservation and small-scale fishing issues, based on a coarse estimate by CEA Consulting.

To address climate issues and systemic inequity, capital needs to flow to underserved communities that also steward coastal areas rich in biodiversity.

What makes the SSF Impact Bond innovative?

By aligning financial returns with climate adaptation and biodiversity outcomes, the bond creates an attractive impact investment for stakeholders focused on long-term environmental and social impact. This innovative OBF approach links funding to real-world impact.

By focusing on outcomes like sustainable fisheries, increased fish biomass, and stabilized benthic cover, the Bond ensures that every dollar contributes to tangible, lasting change.

“The Small Scale Fisheries Impact Bond exemplifies the kind of solution we need for scalable, community-driven conservation. By focusing on outcomes, we can drive real impact that benefit both people and the planet while setting a precedent for how future conservation efforts are funded.”

– Karen Sack, Executive Director at ORRAA

Linking repayments to verified outcomes creates transparency, mitigates investment risk, builds trust, and ensures accountability to make the bond appealing to private investors. The bond creates a pay-for-results model where risk-averse governments will be able to allocate budget as outcome funders to already achieved impact.

This approach de-risks investment in a vast, underfunded target market, overcoming barriers that keep communities excluded from the formal market and at increased risk of climate vulnerability and food insecurity. It also addresses the timing gap common in coastal ecosystem recovery, where results like fish biomass increase take years to materialize, but funding is needed upfront for implementation.

The Bond is a scalable solution for managing fisheries and marine biodiversity, providing countries with a vital pathway to meet their 30×30 goals—protecting 30 percent of land and sea by 2030—while supporting sustainable development and climate resilience. As this initial Bond rolls out, the project partners are already laying the groundwork for replicating and scaling the model. The SSF Impact Bond will be scaled to protect, restore, and sustainably manage thousands of hectares of coastal ecosystems.

Where is the investment going?

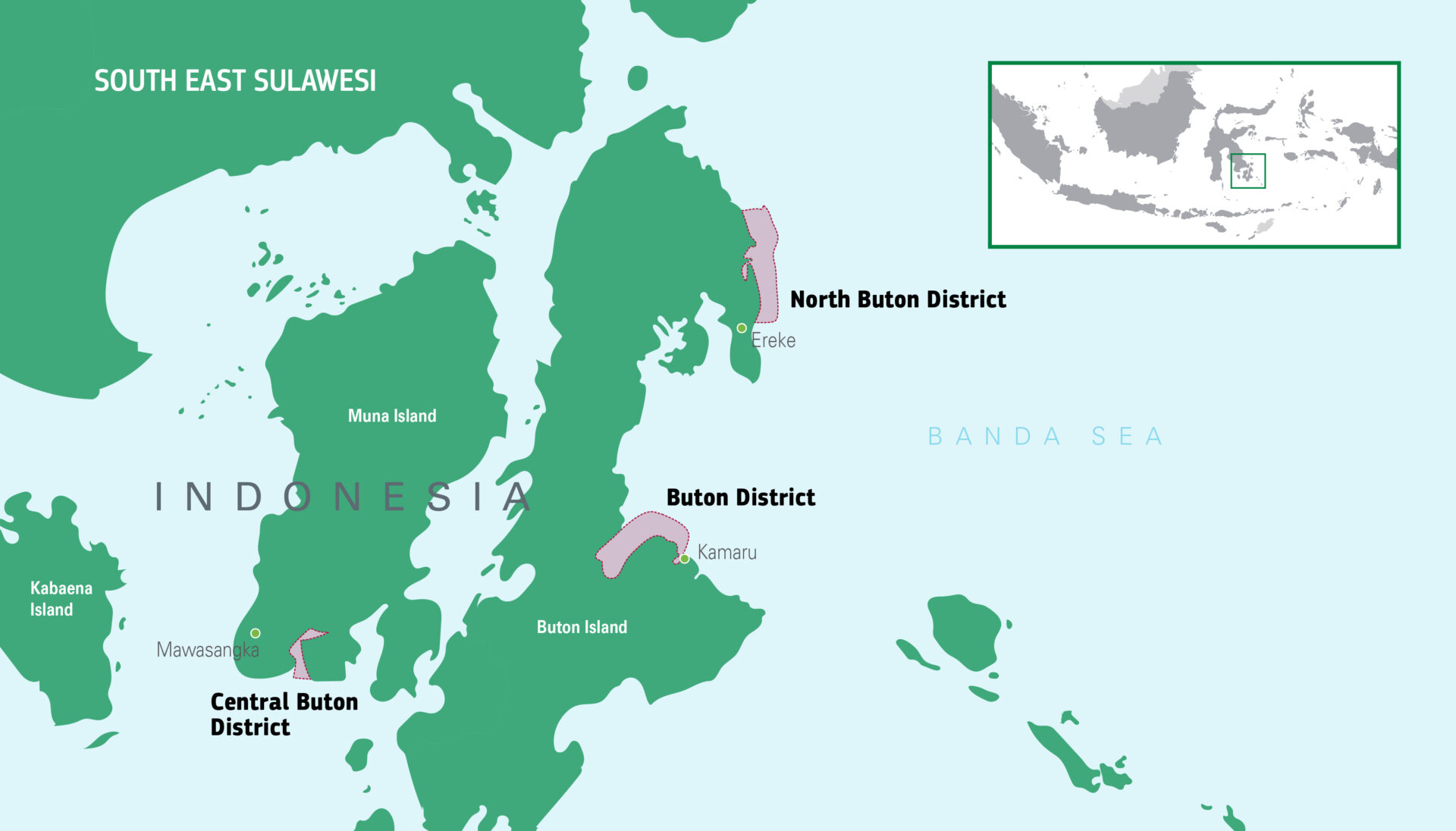

The initial investment will fund the Bond’s pilot: the establishment of three new “Managed Access with Reserves (MA+R),” areas in Southeast Sulawesi, Indonesia. Supporting the UN’s 30×30 targets, these MA+Rs will be established as Other Effective Area-Based Conservation Measures (OECM), while the impact bond revenue will formalize and strengthen SSF microbusinesses, building resilience for the community management of SSFs.

Indonesia’s ambitious commitments to achieving 30×30, and Rare’s long-standing relationship with its communities and government, make the country a natural starting point. Southeast Sulawesi, in particular, has led the way in MA+R formalization nationally, recently providing formal recognition of 100,000 hectares of managed and reserve areas.

Based on a decade of work to foster community-led conservation and revitalized coastal fisheries, this pilot Bond will help us refine the model, metrics, and methodology for scaling the networking of marine reserves.

Who is investing in the SSF Impact Bond?

Initial Investors

Pershing Square Foundation

Minderoo Foundation

Outcome Funders

UK DEFRA through the Ocean Risk and Resilience Action Alliance (ORRAA

Milkywire

Rumah Foundation

Builders Vision

Pershing Square Foundation

Walton Family Foundation

Technical Partners

Levoca

Reed Smith

Why Small-Scale Fisheries?

Nearly 500 million people at least partially depend on small-scale fisheries, most of which are in the thin band of coastal ocean waters just offshore.

Community Seas:

Vital to People & Biodiversity

| 40% of global fish catch |

70% of ocean biodiversity |

| 113 million people employed |

100% of mangroves and seagrass beds |

| US$58 billion in estimated catch value |

83% of coral reefs |