A year after unveiling its innovative Small-Scale Fisheries (SSF) Impact Bond at COP28, Rare and its partner network of investors and implementers are set to put the innovative funding mechanism into action.

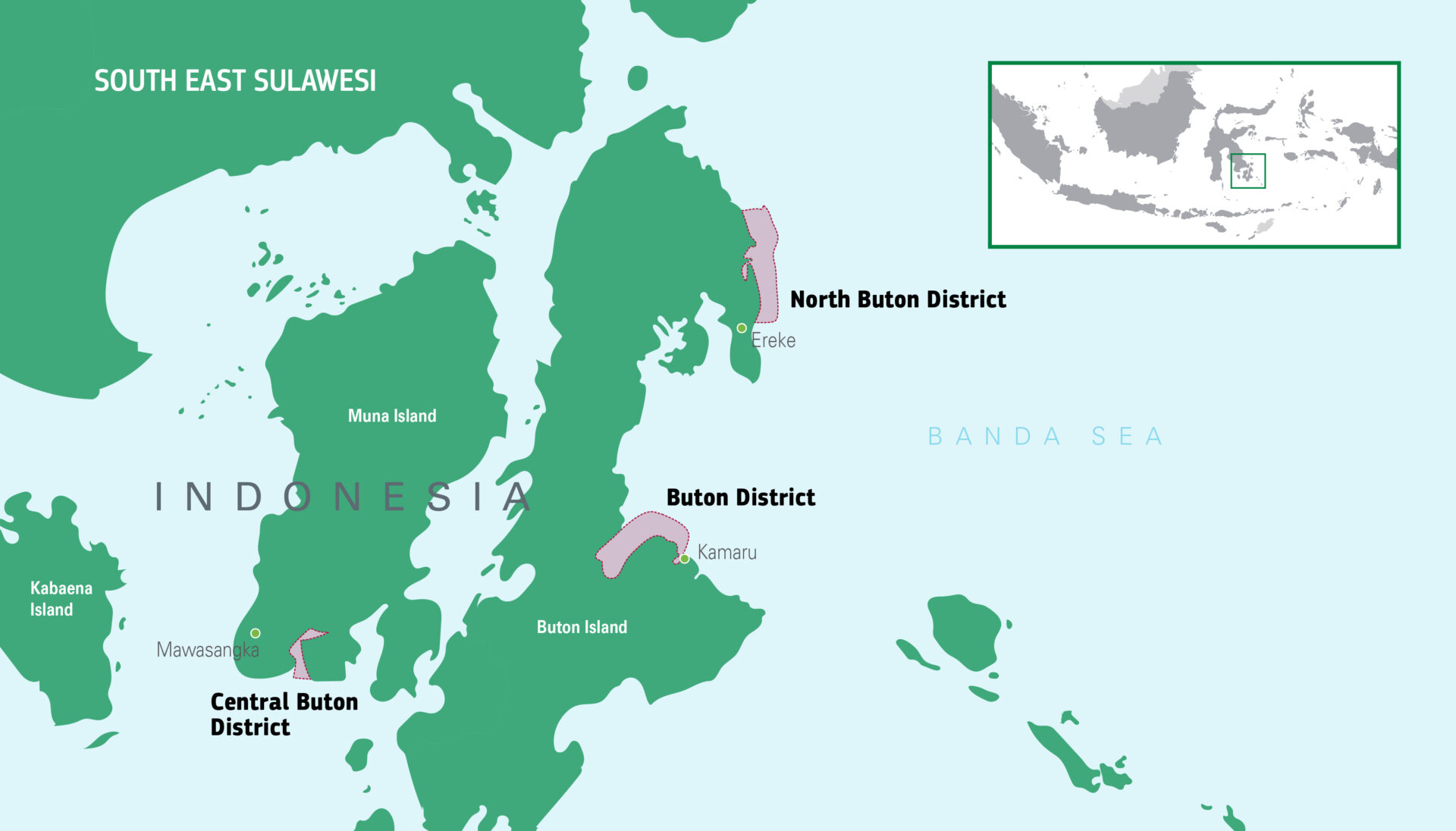

After securing USD 6 million, the Rare Indonesia team selected three small-scale fishing communities along the coast of Southeast Sulawesi, Indonesia, to receive funding from the SSF Impact bond to establish community co-managed protected areas.

The three chosen sites are Kulisusu Utara 1, Mawasangka Tengah, and Lasalimu in Southeast Sulawesi. The sites were selected after a rigorous evaluation process. Each site is in a District where Rare currently works with communities and local and regional government leaders, and each have sufficient infrastructure and population to support the bond’s implementation.

“This is a monumental step for the Small-Scale Fisheries Impact Bond as we begin to channel critical funding to communities on the frontlines of climate change and the biodiversity crisis,” said Kate Schweigart, Vice President of Innovative Finance at Rare. “With the incredible talent and drive of our team in Indonesia, I am confident this pilot will set the stage for fully operational and financially sustainable community-led fisheries management.”

Southeast Sulawesi, Indonesia: The ideal pilot location

Indonesia is the ideal location to pilot the SSF Impact Bond. In 2022, the Indonesian government set ambitious goals for achieving the Global Biodiversity Plan’s target of conserving 30% of the world’s lands, inland waters, coastal areas, and oceans by 2030 (30×30). In addition to traditional protected areas, Indonesia explicitly stated the importance of including other effective conservation measures (OECMs) against its 30×30 goal. OECMs, unlike traditional protected areas, allow sustainable use of natural resources by local and Indigenous populations that rely on those resources for food security and income.

The Bond’s funding will support establishing three Managed Access with Reserves (MA+R) sites. MA+R is a type of OECM that pairs sustainable use with protection of coastal waters, putting local government and local fishers in control of their assets. When managed well, OECMs and MPAs can safeguard over half of Indonesia’s seagrass and coral reef habitats. Ultimately, the Bond sites will showcase the coexistence of MPAs and OECMs to support coastal and marine conservation.

A new model of financing small-scale fisheries management

Small-scale fisheries have an outsized impact on global food security and ecological balance. In addition to employing 113 million people worldwide, these fisheries are mainly located in coastal seas, which are home to 70% of ocean biodiversity, 100% of global mangrove forests, and 83% of coral reefs.

However, managing small-scale fisheries sustainably and reaching the global goal of protecting 30 percent of the ocean by 2030 requires at least US$9 billion — 9 times greater than current global spending. Philanthropy cannot do it alone, highlighting the need for innovative financial models that engage the private sector.

“Protecting 30% of marine areas of important habitats is one thing, but the imminent challenge is to get enough funding to ensure these areas function well,” says Hari Kushardanto, Vice President of Rare Indonesia. “Our Impact Bond Model will become an innovative fundraising model where private sectors and philanthropists can contribute to more effective conservation initiatives.”

Impact Bond: From concept to implementation

Rare unveiled the SSF Impact Bond during an event at COP28 focused on financing ocean climate action. The Bond is based on an outcome-based financing (OBF) structure. The key mechanism behind OBF is that investors are repaid by outcome funders only when pre-defined results have been achieved and independently verified. By focusing on outcomes like establishing sustainable fisheries, increasing fish biomass, and stabilizing marine habitats, the Bond ensures that every dollar contributes to tangible, lasting change.

OBF models have been successfully deployed in other sectors, such as health, education, and poverty alleviation. As a new blended finance vehicle, the SSF Impact Bond offers the opportunity to scale solutions for helping countries deliver on their 30×30 goals.

Structured to be implemented over five years, investors including Pershing Square Foundation (PSF) and Minderoo Foundation, are providing upfront capital to fund the project. Outcome funders include UK DEFRA through the Ocean Risk and Resilience Action Alliance (ORRAA), Milkywire, PSF, Rumah Group, the Builders Initiative, and the Walton Family Foundation. Rare worked with Levoca to complete the design and technical feasibility study for the Bond and Levoca will be providing performance management during project implementation. Reed Smith LLP is international counsel.

As this initial Bond rolls out, the project partners are already laying the groundwork for replicating and scaling the model. The SSF Impact Bond will be scaled to protect, restore, and sustainably manage thousands of hectares of coastal ecosystems. Importantly, this first-of-its-kind SSF Impact Bond will de-risk future investment in small-scale fisheries and the blue economy.